Centralized digital currencies, also known as digital fiat currencies, are digital versions of traditional fiat currencies such as the US dollar or Euro. They are issued and controlled by a central authority, typically a government or central bank. Examples of centralized digital currencies include China’s Digital Yuan and the proposed digital dollar in the United States.

Decentralized digital currencies, also known as cryptocurrencies, are not controlled by any central authority. Instead, they operate on a decentralized network, typically using blockchain technology. The most well-known example of a decentralized digital currency is Bitcoin, but there are thousands of other cryptocurrencies in existence.

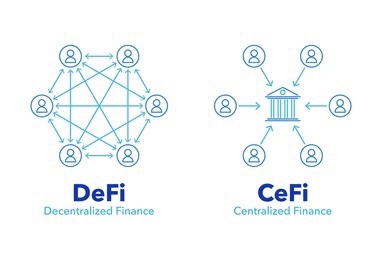

One of the key differences between centralized and decentralized digital currencies is the level of control and transparency. Centralized digital currencies are controlled by a central authority, which has the power to issue new currency, track transactions, and even freeze or seize assets. This level of control can be seen as both a strength and a weakness. On one hand, it allows for greater control over monetary policy and can help prevent inflation and financial crises. On the other hand, it also gives the central authority a significant amount of power over individuals and can lead to issues such as privacy violations and censorship.

Decentralized digital currencies, on the other hand, operate on a decentralized network, with no central authority controlling the issuance or tracking of transactions. This allows for a high degree of autonomy and privacy for individuals, but also means that there is no central authority to prevent inflation or stabilize the value of the currency. Additionally, decentralized digital currencies are often associated with illegal activities such as money laundering and tax evasion, due to the anonymity they provide.

Another key difference between the two is in terms of scalability and transaction speed. Centralized digital currencies can process a large number of transactions in a short amount of time, but this often comes at the cost of privacy and security. Decentralized digital currencies, on the other hand, may have slower transaction times but offer a higher level of security and privacy.

In essence, centralized and decentralized digital currencies both have their own unique advantages and disadvantages. Centralized digital currencies offer greater control and stability, while decentralized digital currencies offer more autonomy and privacy. Both have their own unique use cases, and it’s likely that we will see a combination of both in the future as the technology and regulations around digital currencies continue to evolve. Til next time, good business sells itself….