A central bank digital currency (CBDC) is a digital version of a national currency that is issued and backed by the central bank of a country. It can be used by individuals and businesses to make electronic payments and can be stored in digital wallets or on other types of digital platforms.

CBDCs differ from other types of digital currencies, such as Bitcoin and Ethereum, in that they are issued and backed by a central bank. This means that they are considered to be a more stable and trustworthy form of digital currency, as they are backed by the full faith and credit of the central bank.

In general, a CBDC is a digital version of a national currency that is issued and backed by the central bank of a country. It can be used by individuals and businesses to make electronic payments and can be stored in digital wallets or on other types of digital platforms. Some people have suggested that CBDCs could potentially offer a number of benefits, such as increasing financial inclusion and making it easier for people to access and use financial services, but there are also potential risks and challenges associated with their use.

In recent years, the concept of a central bank digital currency (CBDC) has gained a lot of attention from governments, central banks, and the general public. But what exactly is a CBDC, and why is it generating so much interest?

A CBDC is a digital version of a national currency that is issued and backed by the central bank of a country. It can be used by individuals and businesses to make electronic payments and can be stored in digital wallets or on other types of digital platforms. This is similar to the way that people currently use debit and credit cards, or digital payment services like PayPal, to make electronic payments.

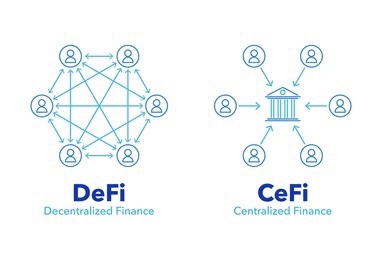

One of the main differences between a CBDC and other types of digital currencies, such as Bitcoin and Ethereum, is that a CBDC is issued and backed by a central bank. This means that it is considered to be a more stable and trustworthy form of digital currency, as it is backed by the full faith and credit of the central bank.

There are a number of potential benefits to using a CBDC. For example, it could increase financial inclusion by making it easier for people to access and use financial services, particularly in areas where there is limited access to traditional banking infrastructure. CBDCs could also make it easier for people to make and receive payments, as they could be used to send and receive money instantly, without the need for intermediaries like banks or payment processors.

However, there are also potential risks and challenges associated with the use of CBDCs. One concern is that the widespread adoption of a CBDC could disrupt the traditional banking system and potentially lead to the disintermediation of banks. There are also questions about how a CBDC would be regulated and how it would interact with other financial assets and instruments.

Despite these challenges, central banks around the world are actively studying the potential impacts and implications of issuing a CBDC. Some countries, such as China and Sweden, have already made significant progress in this area, while others, like the United States and the European Union, are still in the early stages of research and development.

Overall, the concept of a CBDC is a complex and multifaceted one, and it will likely be some time before we see any widespread adoption of this technology. However, as the world becomes increasingly digital and interconnected, it is likely that we will see more central banks exploring the potential benefits and challenges of issuing a CBDC in the future. Til next time, good business sells itself….#peace